Infrastructure Platform-as-a-Service – Opening newer avenues for innovation in payments for the Banks

India is one of the fastest growing fintech markets in the world with a market size of $31 Bn in 2021 and is expected to reach $1 Tn by 2030, as highlighted by Dr. V. Anantha Nageswaran, Chief Economic Advisor of India, Ministry of Finance, Government of India, at the recently concluded Global FinTech Fest, held in Mumbai. This growth provides opportunities for banks and fintech to collaborate and create newer technology-led innovations to transform the lives of the common people. These partnerships can drive an important transformation in the area of credit delivery, especially in rural and semi-urban areas.

Infrastructure Platform as a Service (iPaaS) is one such area where banks and other traditional financial institutions need to focus on, for bringing disruption in the industry and to address the three main issues currently faced by them:

Fintech’s/Technology Service Providers (TSPs) and Traditional Financial Institutions should leverage their existing partnerships/collaborations for creating consumer-driven solutions through iPaaS to enable the financial ecosystem to grow and flourish.

What is iPaaS and its relevance?

iPaaS is the infrastructure provided by new-age fintech to connect with the bank systems directly via APIs to facilitate various banking options – loans, cards, deposits, payments, etc. It can standardise how applications are integrated within an organisation, making it easier to automate business processes and share data across applications securely.

Companies can offer iPaaS products and services, in the following categories:

- Card Issuance Infrastructure

- Lending

- Insurance

- Mutual Funds

- Payments and Deposits

How will iPaaS play a role in the growth of Banks?

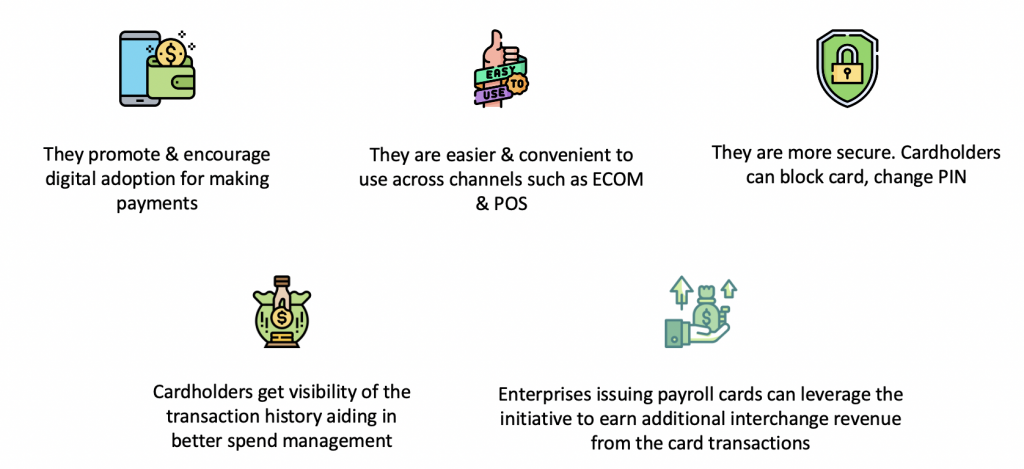

With the support from the fintech industry, there is a strong acceleration that the banking & financial sector has witnessed with regards to the growth of digital and consumer banking. With banks and fintechs having their own competencies, a partnership between them would be more meaningful to usher in fruitful results in the conservative banking world and this is where technology like iPaaS can help in:

- Accepting new technologies: Enabling banks to replace the legacy infrastructure and adopt new technology for launching new products and services.

- Win-win situation: Low cost of integration for banks as they ride on the infrastructure provided by fintech/TSPs, resulting in a higher rate of return for banks and new customers for fintech/TSPs.

- Regulatory Support: Banks can have a faster GTM strategy as they get all the regulatory support from the fintech/TSPs in terms of certifications, licences, and other such regulatory approvals.

- Safe & Secure Transaction: Leverage the cutting-edge technology of fintech with banks still being the transaction authenticating authority. It will ensure safety and security in all transactions.

- Launch a wide range of Products & Services: Banks in partnership with fintech can explore providing a wide range of products and services to customers. It will attract new customers and allow banks to face cut-throat competition in the market.

- Transacting at ease: The bank consumers will be at an advantage to transact using the latest technology and save on transaction time, effort, and money.

How CARD91 is providing the complete infrastructure to the Banks

CARD91 has developed an end-to-end of issuance infrastructure (switch) platform including card lifecycle management, settlement platform and other issuance products. Its offerings include:

- Card Issuance Infrastructure for Prepaid/Debit/Credit Cards

- Access Control Server (ACS)

- UPI Switch and Connectors

- System of Records

CARD91 provides a fully configurable orchestrated system for banks to help them develop, customise, integrate, and go live with new solutions faster. In addition to this, with one TSP, the bank can launch multiple products with minimal time and effort. In return, it provides an opportunity for the bank to cross-sell leading to new customer acquisition and brand promotion.

The Future is DIGITAL

With the government’s push towards digital initiatives and increase of consumer needs/expectations, there’s no doubt that we will be witnessing more digital financial products in the future. However, to bring the next big wave of innovation, banks need to be early adopters of technology like iPaaS, leading to beneficial partnerships and an interactive ecosystem for all the stakeholders.

Write to us at sales@card91.io to know how we are helping banks in their digital journey.

Authored by Shalki Galhotra, Sr. Manager, Sales & Partnerships.