How to power your business using Credit-Card-as-a-Service?

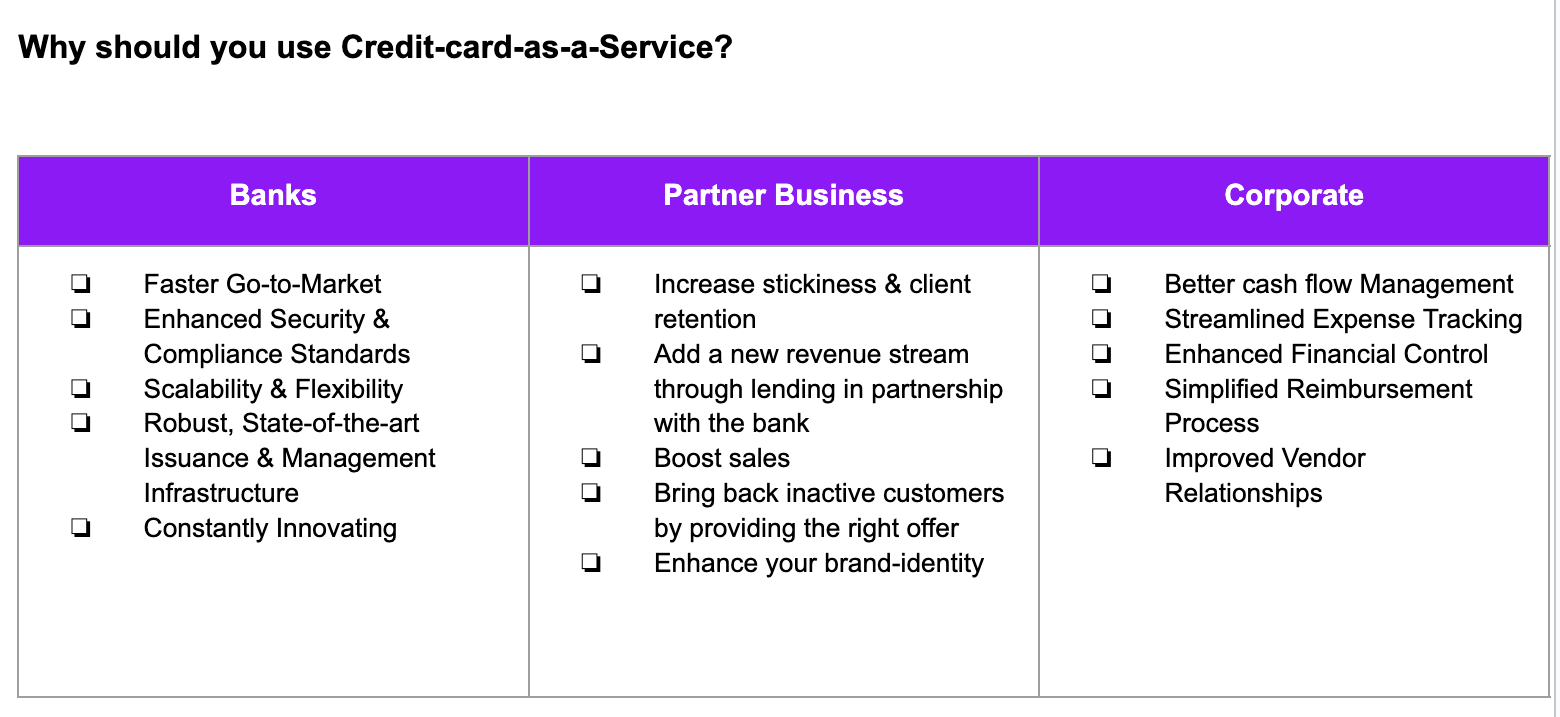

The credit card industry has achieved an unprecedented 50% growth in the last 3 years, thanks to the utilisation of co-branded cards. Large traditional banks and fintech businesses are aiming to cultivate stronger brand loyalty, increase brand visibility, and drive revenue growth by deploying more credit cards in the market. In addition to this, credit card issuers want access to a captive audience that the businesses have, in order to cross-sell other banking products.

Earlier, launching a credit card program took banks & businesses several quarters or sometimes even years. But, today, we live in a simpler, faster, super-modular world. Fintechs have changed the financial services landscape beyond recognition. With the rise of open banking, the credit-card stack is available for businesses and banks in an easy-to-integrate, plug-and-play fashion. In this article, we take a closer look at credit card-as-a-service.

What is Credit-card-as-a-Service?

Credit cards in India can be issued solely by Regulated Entities, which in most cases are Scheduled Commercial Banks (SCB) and rarely Regional Rural Banks through their sponsor SCBs or NBFCs with explicit approval from the regulator. Credit-card-as-a-service can be of the following types:

As Technology Service Provider (TSP) to Banks: To bolster the regulated entities’ tech capabilities for card issuance and management, the banks tend to outsource such services to technology service providers specialising in products like credit cards.

Co-Branding Integration: Partner Businesses can issue personalised co-branded cards to their customers by integrating with a Credit-card-as-a-service provider, which in turn does all the requisite plumbing with the issuing entity and the card networks. The role of the co-branding business partner in this transaction will be limited to that of a marketer/distributor.

Inside the Machine.

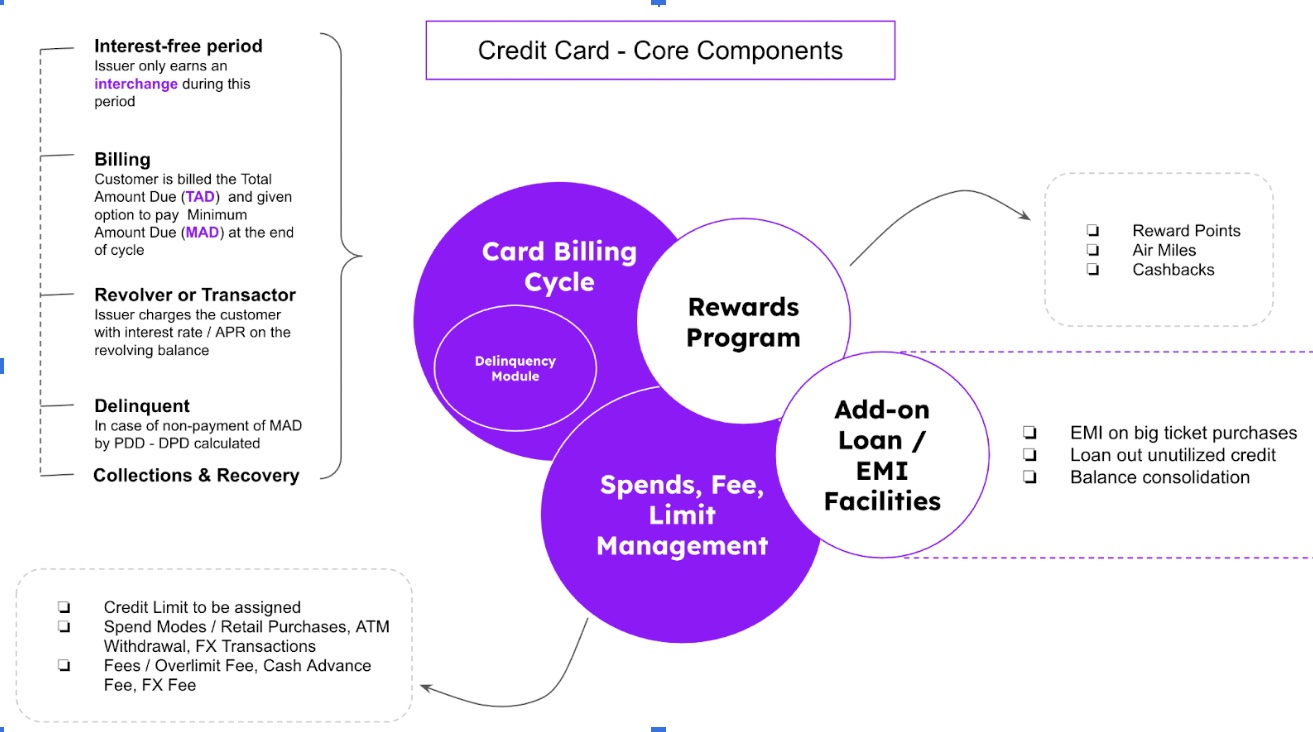

A credit-card-as-a-service provider takes care of the following modules, depending upon whether the card being issued is a secured or an unsecured one so that you can focus on your topline and bottomline.

Application Processing & Onboarding: The process of enrolling and setting up a new customer account with the credit card issuer.

Card Personalisation and Issuance: Customising and producing physical credit cards with personalised details for approved applicants.

Card Activation: Enabling the functionality of a newly issued credit card for the cardholder to start using it.

Card Replacement / Hot-listing / Renewal: Handling requests for replacing lost, stolen, or damaged credit cards, blocking cards reported as lost or stolen and renewal of expired cards.

Card Management: Overseeing the ongoing administration and maintenance of credit card accounts, including credit limits, usage monitoring, and account updates.

Card Plastic Specifications Compliance: Ensuring that the physical credit cards meet industry standards and compliance requirements.

Authorisation Processing: Verifying and approving transactions made using the credit card by checking available credit and account status.

Open to Buy: The remaining credit limit available for the cardholder to use after accounting for existing charges and pending transactions.

EMI: Enabling cardholders to convert large purchases into equal monthly instalments for easier repayment.

Billing Module: Generating and managing credit card statements with detailed transaction information and payment due dates.

Fee Management: Administering and collecting various fees associated with credit cards usage, such as annual fees or late payment fees.

Rewards Program: Implementing and managing a program that offers cardholders rewards or benefits based on their credit card spending.

Operations: The overall management and coordination of the credit card service, including settlement & recon, customer support, fraud prevention, and compliance.

Notifications & Alerts: Sending timely notifications and alerts to cardholders regarding transaction updates, payment reminders, and security alerts.

Delinquency Module: Managing and addressing instances of late or missed credit card payments by cardholders.

Data Management: Safeguarding and managing the collection, storage, and processing of cardholder data in compliance with data protection regulations.

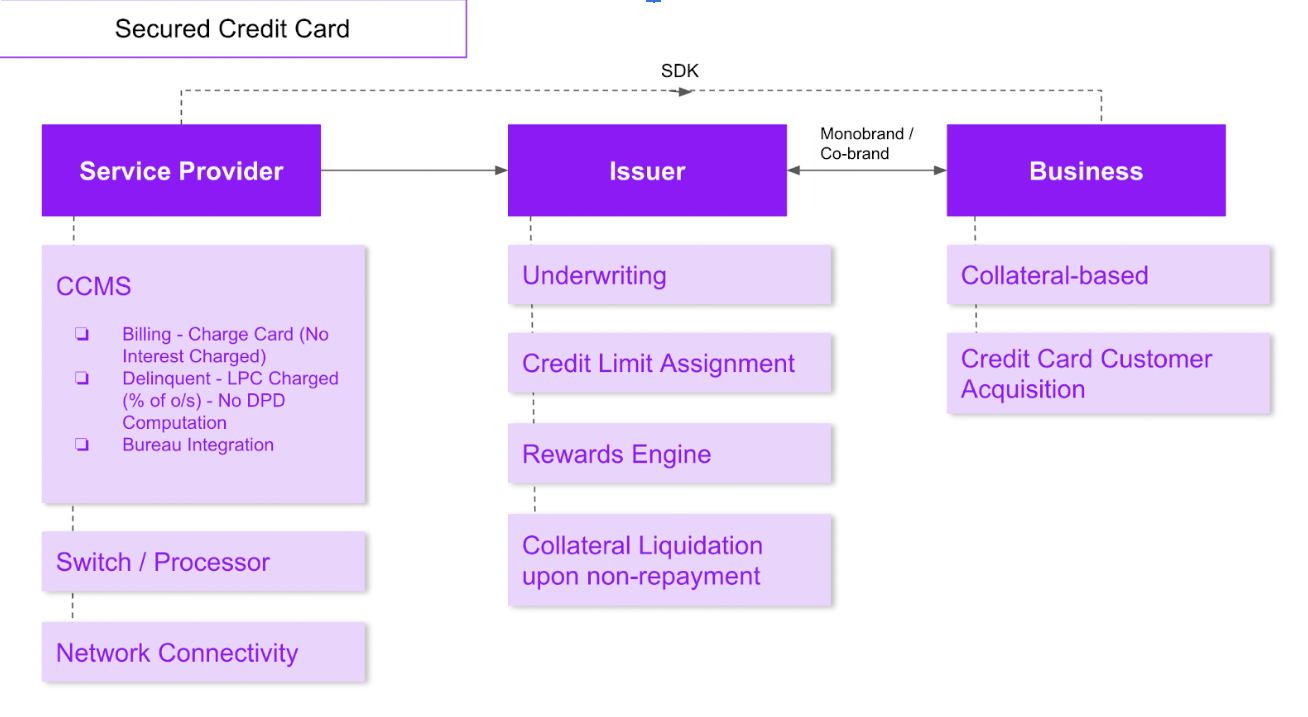

How do the stakeholders interact?

Given below is a sample stakeholder diagram that illustrates how the different parties interact in the issuance & management of a secured credit card by a corporate / business.

CARD91 is building credit-card rails to help Indian businesses and banks launch their credit card programs at industry-best speeds. Reach out to us –

If you are a Bank, looking for a credit card issuance & management solution.

If you are a Business, planning to launch a co-branded credit card.

If you are a Corporate, planning to launch a corporate credit card program for employees.

Authored by Praveen Varghese, Product Manager, CARD91