Digital Payments: Revolutionising India’s Financial Landscape

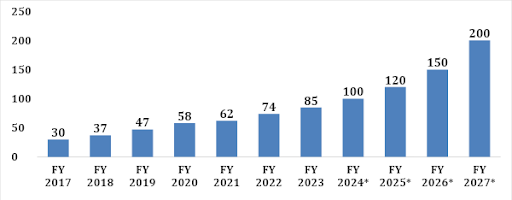

India has experienced a remarkable evolution in its digital payment landscape in recent years. The swift proliferation of smartphones, internet connectivity, and government initiatives such as Digital India, Unified Payments Interface (UPI) NEFT/IMPS, Prepaid Cards/Wallets/Contactless Payments, e-RUPI, CBDC, AEPS, Open Banking/API Integration has significantly contributed to the expansion of digital payment methods throughout the nation. A strong tailwind to digital/contactless payments was provided by demonetisation and Covid-19, leading the way for a cashless economy and better tax compliance. This blog explores the latest digital payment trends reshaping India’s financial landscape.

Unified Payments Interface (UPI) Dominance

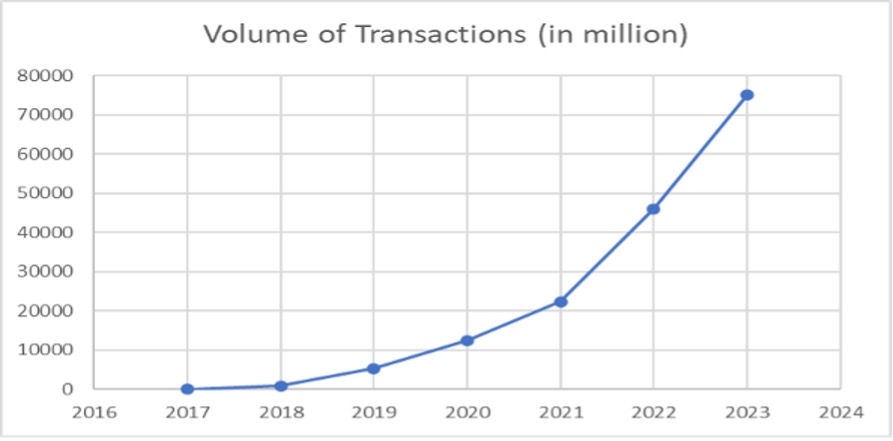

The Unified Payments Interface (UPI) has been a game-changer in the Indian payments industry. Launched in 2016 by the National Payments Corporation of India (NPCI), UPI enables users to link multiple bank accounts and execute real-time peer-to-peer transactions. UPI has witnessed exponential growth, with transaction volumes crossing the billion-mark monthly. Its success can be attributed to its simplicity, security, and interoperability across various payment apps.

IMPS/NEFT

IMPS and NEFT have revolutionised the way funds are transferred in India, providing individuals and businesses with fast, secure, and convenient payment options. Whether you need to send money urgently or make routine payments, these electronic funds transfer systems offer unparalleled accessibility and flexibility.

Prepaid Cards, wallets and Contactless Payments

Digital wallets and Prepaid cards have gained significant traction in India, allowing users to store funds digitally and make quick payments. The COVID-19 pandemic further accelerated the need for contactless transactions and contactless payments. NFC-enabled cards, QR code payments, and mobile payment solutions are increasingly prevalent, allowing consumers to make secure transactions without physical contact. Today, merchants are offering contactless payment options to provide their customers with a safer and more efficient checkout experience.

New Government Initiatives:

The Government of India has played a pivotal role in promoting digital payments through its flagship initiatives, such as Digital India, e-RUPI, CBDC and many more. Digital India aims to transform India into a digitally empowered society by promoting digital literacy and providing digital infrastructure.

o e-RUPI is a wholly cashless and no-contact electronic payment instrument that will be delivered to beneficiaries’ mobile devices (even mobile devices that are non-android or iOS) as either a QR code or an SMS-based e-voucher.

o CBDC is a digital currency issued by a central bank, rather than a commercial bank. Backed by blockchain technology, this central bank digital currency (CBDC) is an electronic version of the physical rupee, potentially representing a more secure and government-supported alternative to private digital currencies

AePS

India has witnessed rapid growth in biometric authentication for digital payments. The Aadhaar-enabled Payment System (AEPS) allows individuals to link their bank accounts with their unique Aadhaar identification number and make transactions using biometric verification. This technology has simplified payments for the underbanked population, making financial services more accessible and inclusive.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionising the digital payments landscape in India. With AI-powered chatbots, payment service providers are enhancing customer support to address queries effectively. ML algorithms are leveraged to detect and prevent fraudulent activities, ensuring secure transactions. Moreover, personalised recommendations and targeted offers based on user behaviour are being utilised to drive customer engagement and loyalty.

Open Banking, driven by the Reserve Bank of India (RBI) guidelines, is a game-changer in the banking sector, allowing secure sharing of customer data between banks and fintech companies. Application Programming Interfaces (APIs) facilitate the seamless integration of various financial services, allowing customers to access multiple banking services through a single platform. This collaborative ecosystem encourages innovation and empowers customers with a variety of payment options.

As India moves towards a cashless economy, these trends will continue to shape the future of digital payments, driving financial inclusion and economic growth.

CARD91 is an API-led issuance Platform-as-a-Service company. It offers unparalleled technology infrastructure to banks, SMEs, corporates & fintech through its Switch and Card Management Solutions for Prepaid Cards, Multi-Currency Travel Cards and allied systems like Centralised System of Records (C-SOR) for prepaid cards, credit cards and Access Control systems (ACS)