After reading Amit’s blogpost that projects a whopping doubling of the credit card customer base within the next 4 years, I could not help but wonder which is the major segment of India’s population that could qualify as “The Aspirational Indians”. It didn’t take me a lot of effort. With the cues that the economic growth of India is throwing at us – premiumisation trend, luxury / revenge travel, rising number of entrepreneurs, etc. – I could easily conclude that it’s the Gen-Z that’s driving credit card growth.

Okay, now how do you lure this class of potential credit card customers? I remember students of top B-schools getting free credit cards from established issuers. But what about the rest of the young aspirationals? We all know there’s enough competition with some legacy Issuers who’ve got the proverbial “first-mover advantage”, but that also implies they’ve got the legacy systems! How can the next generation of Issuers work using first principles and craft a lean and superior product? We, at CARD91, will surely answer this question in the next few days to come ☺

However, for now, let’s just focus on the specific preferences, lifestyle, and spending habits of this demographic. Here are some features that I felt could be appealing:

Instant Card Issuance:

Millennials hate to wait! If an Issuer imbibes this core principle, a major advantage over legacy Issuers is already gained. Quick and easy application processes with instant card issuance for immediate use are absolutely non-negotiable for Gen Z.

Credit Card on UPI:

Although one may be new to credit card, UPI is omnipresent now! Gen Z is pretty familiar and comfortable using UPI and therefore, this is one of the must-have features to capture the market especially when the legacy issuers are still struggling to make it functional.

Reward Programs for Online Shopping, Food Delivery, Dining, and Entertainment:

Tailored rewards or cashback for online shopping on popular e-commerce platforms, special discounts on food delivery services or dining at partnered restaurants, and exclusive access to movie theatres, streaming services, music subscriptions, and live events are a must have!

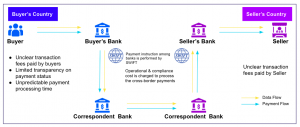

Low Forex Markup for International Travel:

Unlike the previous generations, Gen Z is more keen to discover the world from an early age. Since it may still not be earning much, a LOW / ZERO FX mark-up feature on credit cards is surely a hotseller!

Travel Rewards for International or Domestic Trips:

Millennials are explorers in the true sense – domestic or international travel is always on their mind, and on the cards 🙂. Travel-related benefits such as discounts on domestic flights, hotel bookings, or holiday packages within India, exclusive lounge access, and waiver on fuel surcharge are needed in every credit card targeted at this generation.

Local Lifestyle Perks:

Millennials consider work-life balance very important in their overall well-being and are spoilt for choices when it comes to including “life” in their lifestyle! An Issuer must get into partnerships with local brands, gyms, spas, or wellness services to provide discounts or exclusive offers.

Financial Management Tools:

Millennials are eager to learn about building a large corpus. Budgeting features, spending insights, and real-time notifications to help cardholders manage their finances effectively can be a good attraction. An educational initiative on how to get maximum benefit from a credit card by being a transactor can help. Also, a tie-up with any personal finance assistant offering discounted or complimentary services is a plus point.

Customized Offers:

Millennials love personalized experiences! AI-led tailored promotions and discounts based on spending patterns and preferences can be a good draw.

Gamified Rewards:

Accelerated rewards with increasing spends and other milestones can hold this generation’s interest and drive higher card usage.

Language and Regional Support:

Although we are a large, English speaking nation, there’s an even larger chunk of population (Gen Z included) that still prefers Hindi or a local language. To create that “wow” factor, the Issuer can offer customer service and mobile app interfaces that support multiple languages and cater to regional preferences.

Student-focused Features:

Career development is an important focus area for this generation. The Issuer that can give access to online courses, career-building resources, student discounts, or networking events to support professional growth will surely have an edge over others.

Flexible Credit Limits:

Millennials are either yet to start their professional journey or are in a very early stage. Cards that allow for flexible credit limits based on income and spending habits, giving users more control, are certainly more acceptable.

Green Initiatives:

With the increasing exposure to sustainability initiatives in academic institutions over the last few years, even my daughter teaches a lesson or two to me! Issuers offering cards manufactured in an eco-friendly manner or those with features that contribute to environmental causes will be able to emotionally connect with Gen Z millennials!

Collaborations with Local Influencers:

This generation has a far more extensive online social presence than physical presence. Partnering with popular local influencers or celebrities who are active online for exclusive offers and promotions can drive higher card usage.

Understanding the local culture, preferences, and the unique challenges faced by millennials in India is crucial to design the right credit card product that resonates with this demography. Additionally, keeping up with the rapidly evolving digital landscape and incorporating technology-driven solutions will likely appeal to the tech-savvy nature of millennials.

If you’re an Issuer, no time better than the present to launch a credit card product for this generation.

Authored by Shailabh Kothari, Director – Sales and Alliances at CARD91