3-D Secure 2.0 – Making transactions Simpler and Safer

Preventing fraud plays a significant role in the digital payments space. We must have encountered many frauds, both online and offline, during our lifetime.

Unfortunately, the search for effective methods to eradicate fraud never ends. Fraudsters will always find new methods to commit crimes. There are many tools available to end the same, the latest one being 3-D Secure.

What is 3-D Secure?

Putting it simply, 3-D Secure is an additional layer of cardholder authorisation added to an online transaction. VISA and Mastercard offer this tool, and it is known as ‘Verified by Visa’ and ‘MasterCard SecureCode,’ respectively.

3-D Secure is a three-sided security system that provides security while performing transactions and transferring payment data amongst

- Issuing Bank

- Acquiring Bank

- Payment Gateway (link that connects acquirer and issuer)

How does it work?

Several steps are involved when conducting an online transaction. A few additional steps for 3-D Secure can significantly reduce the risk of online fraud:

- A cardholder enters payment information on a webpage

- Payment provider sends request to check whether 3-D Secure technology is active

- If Yes, the customer is redirected to the 3-D Secure page

- The cardholder who receives the OTP must enter it in the appropriate field

- The result comes in the form of a response to the server of the payment provider

- The payment provider sends data to the acquiring bank

- The acquiring bank authorises the transaction and informs the customer whether the transaction was successful or not

3-D Secure 1.0 v/s 2.0

3-D Secure 2.0 is replacing 1.0 to provide a better user experience, which will eventually lead to successful transaction conversion. The need to enter static passwords is replaced by other methods such as biometrics in 3D Secure 2.0.

3-DS 2.0 examines over 120 data points. If the transaction is deemed low risk, no further action is required; if the transaction is deemed high risk, 3D Secure requires customers to verify their identity through biometrics or two-factor authentication.

Benefits of 3-DS 2.0

With the 3-DS 2.0 update, customers will have a more fluid experience when conducting transactions on both mobile and desktop/laptop devices. Benefits of the latest update are:

- Better User Experience

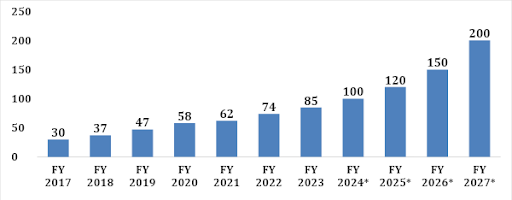

- Increase in Online transactions

- Higher conversion rates

- Multiple Device support

Conclusion

Security is of the utmost importance, especially when customers conduct online transactions. Today, there is a significant shift toward online transactions, and customers must have mental comfort while making these transactions. 3-DS 2.0 makes the transactions safe, seamless and efficient, while also providing a better user experience.