Payroll Cards – Payouts made simpler and seamless

Picture this scenario – a collections agency appointed by a lender has hired 1000+ feet-on-street (FOS) workforce to facilitate collections from delinquent customers. The dilemma in front of the agency is that almost 60% of these FOS contract workers don’t have a formal savings bank account. How do you manage to pay their salaries?

In recent times we have witnessed the rise of the gig economy which consists of consultants, freelancers and blue collared workforce. As per a NITI Aayog report, in India, the gig workforce is expected to expand to 2.35 crore workers by 2029-30. According to Statista’s 2021 report, India has the second largest unbanked population in the world at a staggering 20% of the population. The above facts and figures coupled together provide a massive opportunity for financial inclusion, perhaps one of the reasons why India has seen green shoots in the Fintech sector, which at large, is trying to solve for the financial inclusion of the new to bank & new to credit base of the population.

The answer to the above challenges lies in a payroll card. Payroll cards are prepaid cards that employers use to load an employee’s salary or wages in lieu of a formal cheque. The funds are distributed each payday, providing an alternative to direct deposit for those who cannot or will not hold a traditional account. Payroll cards are always reloadable, which means a worker uses the same card all the time instead of being issued a new card each payday.

Employees can conveniently access their wages with this setup without the need to maintain an account with a financial institution. They can receive their funds instantly, sometimes up to 48 hours early, depending on the issuer of the card. They don’t need to worry about carrying large sums of cash to purchase necessary items. This also helps enterprises and MSMEs to promote digitisation of payments in-line with the government’s Digital India mission.

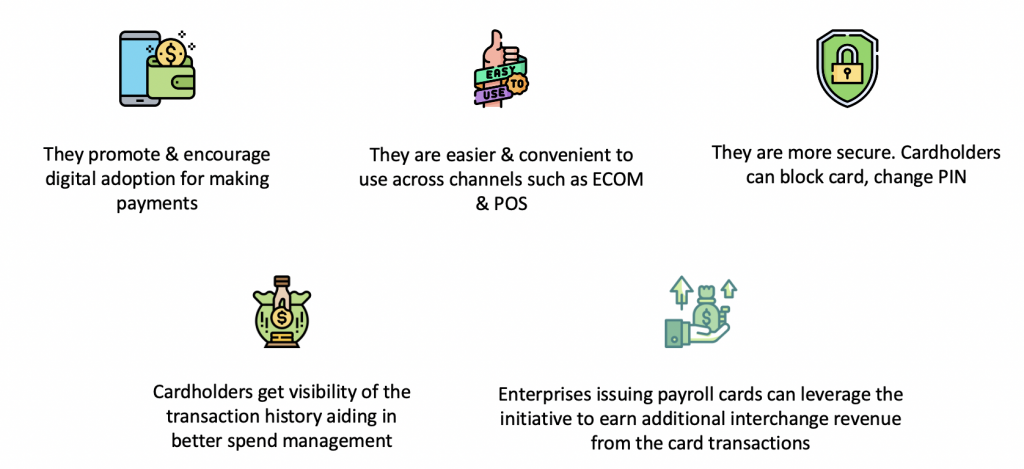

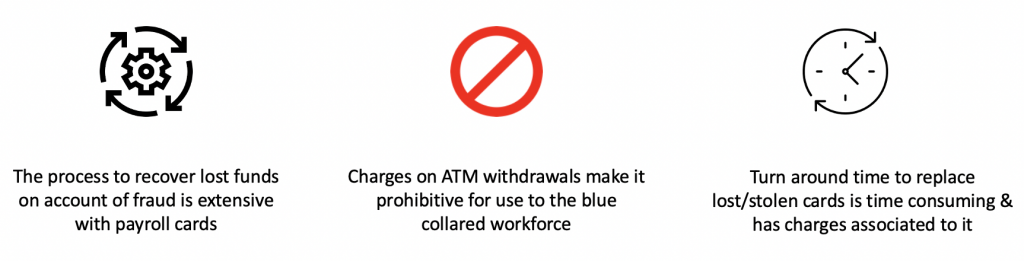

The Pros and Cons of Payroll cards

As with any system of compensation, organisations and employees need to be aware of the pros and cons of payroll cards before using or implementing this type of system. Here are the crucial points to consider:

Benefits of Payroll cards:

Challenges of Payroll cards:

In conclusion, Payroll cards become the logical choice for enterprises and corporations who have a sizable workforce new to the financial ecosystem. They are easy to issue, can be modularized as per the requirements of the enterprise and help in fund management both for the employees and the employer. This can also become an alternate revenue channel for enterprises.

At CARD91, we offer a flexible, robust & scalable full- stack card issuance platform. We work closely with Fintechs & enterprises to help them launch new age card programs in the shortest possible turnaround time (TAT) supporting multiple use cases such as Expense Management & corporate cards, and Payroll Cards to name a few. Our platform is agile which helps us stitch together a custom card program as per the needs of the client.

Still struggling with employee & vendor payouts? Get in touch with sales@card91.io to understand how we can help you transform your payouts to your employees & vendors.

Authored by Bhushan Sawant, Director, Sales & Partnership