Secured Credit Cards – A Credit Score Builder Product

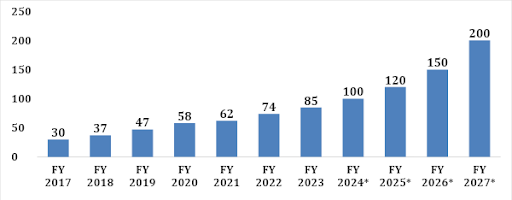

Over the past few years, India’s credit card sector has experienced remarkable growth, boasting nearly 98 million active cards and transaction volume reaching 323 Million in December 2023. Projections suggest that this figure could grow to 190 million cards by 2027, driven by a burgeoning affluent class. Despite this impressive growth, a crucial question looms – is the current credit card penetration rate of 3.5% or projected rate of 7% by 2027 enough? Can we extend the benefits of credit cards to the aspirational class and achieve a card penetration rate of 10% of the population ?

The Indian economy, on its upward trajectory, is expected to witness sustained growth, propelled by rising disposable incomes and an expanding middle class. RBI statistics reveal approximately 98 million active cards, with a monthly spend of INR 1,655 billion in December 2023. Key drivers of this growth include the increasing preference for cashless transactions, enticing rewards programs, the allure of a free credit period, and the synchronisation of repayments with salary receipts. Urban areas, in particular, are witnessing a shift towards credit card usage for transactions, thanks to the proliferation of e-commerce and mobile payments.

A recent report by Goldman Sachs titled “The Rise of Affluent India”, expects that 100 million Indians will be earning US$ 10,000 per annum by 2027. This set of people can easily take the number of cards to 200 million and a card penetration rate of 7% by 2027. And this is a great opportunity for Issuers to expand their customer base and increase usage. However, should we stop at 200 million? How about “The Aspiring Indians”? The rapid pace of digitalization has opened up the doors for Issuers to reach a larger customer base and offer innovative products and services. If done correctly, India can issue cards to 10% of the population by 2027.

Growth of Credit Cards from FY2017 to FY2023 with Estimates until FY27 :-

Source: RBI Data

However, the journey towards a higher penetration rate faces challenges. Key challenges include lack of distribution channels for credit card issuers to broaden their customer base and dissemination of information about the benefits of credit cards. A significant hurdle is the prevailing high rate of credit card delinquencies in India, reflecting a lack of awareness among consumers regarding the importance of timely payments and credit score management.

Addressing these challenges requires innovative solutions, such as the issuance of secured credit cards. This product empowers new-to-credit customers to build their credit history and scores by providing security in the form of Fixed Deposits or Gold, culminating in a credit card with a free credit period and generous rewards and offers. Smaller banks, in collaboration with fintech partners, are likely to spearhead this revolution, gaining assets and liabilities without straining their balance sheets.

Some of the strategies that issuers can use for increasing usage of secured credit cards are:

- A wider geographical and demographic reach: Go beyond urban areas by partnering with local banks, non-banking financial companies, and other organisations to offer credit cards to customers in rural areas.

- A sharper focus on Digital Channels: As more consumers in India become digitally savvy, credit card issuers need to focus on digital channels to reach potential customers. This includes using social media, mobile apps, and online advertising to promote secured credit cards and educate consumers about the benefits of using them. The journey of applying for a card, KYC, creation of FD, lien marking, and card issuance has to be seamless.

- Innovative Product offerings: Differentiation by way of tailor made products for different segments, co-branding, innovative rewards, etc.

- Awareness and consumer education: Increase awareness campaigns to help consumers understand the benefits of credit cards and how to use them responsibly. The key benefit to be propagated is that timely repayments can help create and / or to improve their credit scores.

Amidst technological innovations and a burgeoning economy, credit card issuers have a great opportunity in front of them. Through strategic initiatives and consumer-centric approaches, they can fortify profitability, catalyse digitalization, and provide consumers with a secure avenue for transactions—a pivotal step towards realising India’s digital future.

Authored by Amit B. Shah, Chief Business Officer at CARD91