Payments in Metaverse

What is Metaverse?

Metaverse is a parallel online world enabling users to create their own virtual worlds, early onset of Metaverse came in 2003 with Second Life. Second Life was and is an online multimedia platform allowing users to create an avatar for themselves and have a second life in an online virtual world.

Since the prominence of cryptos and blockchain, Metaverse has seen a resurrection. Often described as the first web 3.0 application, wherein users can create avatars in virtual worlds, socialize, shop, bank, play, and do business. To sum “A shared 3D virtual reality world where people play, socialize, work and buy/sell goods and services”

Why is Metaverse important?

Some of the most important voices have this to say about Metaverse.

“An internet you’re inside of, rather than just looking at” – Mark Zuckerberg, Facebook

“The Metaverse is a massively scaled and interoperable network of real-time rendered 3D virtual worlds which can be experienced synchronously and persistently by an effectively unlimited number of users, and with continuity of data, such as identity, history, entitlements, objects, communications, and payments” – Matthew Ball, Metaverse expert

To sum Metaverse has the potential to be “The NextGen Internet”

How does it affect us?

Metaverse has taken baby steps in defining how we:

Play

- Multiplayer online games with Virtual Reality etc

- Multiplayer with friends, family, or even strangers

- Interactive Gameplay – no more predefined storyline

Socialize

- Interact with friends, family, colleagues, and strangers via VR, AR

- Attend Social Event – Create Social events, even marriages

- New age tourism – boomed during the COVID, VR enhanced real-time tours of some of the best-known places across countries

- Virtual Activities – VR enhanced Treasure Hunt, etc with Friends and Family

Work

- Meetings and Team building – Interact with colleagues via VR, and AR across time zones

- Skilling, training, and workshops – VR enabled training modules for softer to finer skills

- Distance Assistance – Get help from colleagues in the virtual office

- Business Development – Customers and Businesses are operating in Metaverse, why should newer businesses not pitch for business deals in Metaverse itself

Transact

- Purchase – Purchase Virtual items for virtual self, home, office, and business

- Window Shopping and Business Expos – Customers and Businesses both are in Metaverse, selling and buying

- Marketing and Advertising – With Millennials living life in Metaverse, businesses are forced to market and advertise themselves in the Metaverse or they will be left out of the mindspace. JP Morgan has recently launched themselves in Metaverse

So what about payments in Metaverse?

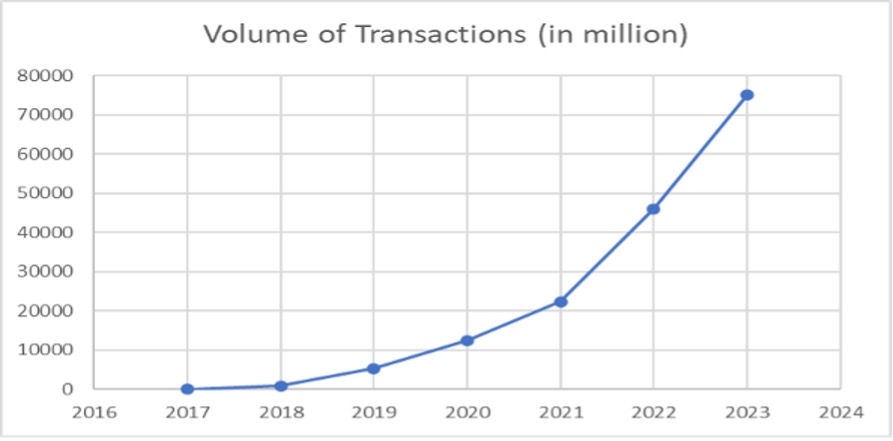

The Metaverse is an estimated $758 billion opportunity by 2026 as per Report Linker Feb 22, 2022. So, people not only have fun in Metaverse but they are doing real businesses and creating wealth in Metaverse. New world should have new payment rails to conduct businesses.

Many platforms rely on traditional payment methods and in-game tokens, but crypto is gaining traction.

Traditional platforms use traditional payment methods like VISA/Mastercard cards etc. They also use in-game tokens (but limited to online gaming space use-case) given they are not accepted at other businesses in Metaverse. Blockchain-based platforms transaction is via cryptocurrencies via platform tokens (e.g. Mana for Decentraland, Sand for Sandbox), that can be bought and swapped on exchanges for other major cryptocurrencies like BTC/ETH, hence they are more interoperable, and easier to withdraw.

One of the key benefits of crypto payments in the metaverse is that they are borderless. Users and businesses can send and receive payments from anywhere in the world with minimal transaction costs and no wait time.

Non-fungible tokens (NFTs) are also gaining popularity as a form of payment. NFTs are digital assets created on blockchain platforms like Ethereum and EOS and are often used as tokens of ownership for digital assets like land, art, and collectibles that are unique. Like cryptocurrencies, NFTs can be easily transferred between users via P2P or exchange-based systems.

To sum it up, Metaverse is a new and exciting opportunity and will need new payment methods which are still evolving. Will it be a fad or a robust business, only the future will tell, but it’s definitely worth exploring.